Our philosophy

The assets of the Patrimonia Foundation, consisting of the contributions grom its insured members, are invested with the aim of efficiently generating the returns that are required to deliver the current and future pensions of its insured members, while having a positive environmental and social impact.

The risks are diversified appropriately and sustainability criteria are taken into account. Investments are made in assets that are linked to the real economy and generate returns: equity (dividends), fixed income (interest) and real estate (rents).

Considering the difficulty in predicting the performance of financial markets in the short term, the Patrimonia Foundation maintains a long-term investment horizon. It systematically rebalances the portfolio between assets classes by following its strategic allocation, without attempting to make short-term predictions about the performance of financial markets. In order to deliver the long-term performance of assets, the portfolio is predominantly managed with inexpensive index funds, without speculating or relying on the ability of individuals to make good investment decisions.

“Far from speculation, our diversified investment strategy is based on the real economy and aims to create sustainable wealth”

The Patrimonia Foundation is convinced that its returns, derived from the real economy, can only be generated in the long term by creating supporting a sustainable, cost effective, socially equitable and environmentally responsible sustainable prosperity.

It consequently invests responsibly by incorporating sustainability criteria (environmental, social and governance – ESG) into all its activities. For the management of its marketable securities, it is convinced that a responsible and engaged investor has a positive impact on society and the environment. It prefers sustainable investment approaches that apply best practices and promote continuous improvement and specifically commit to achieve carbon neutrality by 2050.

It maintains and renovates its properties in order to reduce their energy consumption and uses renewable energy sources where feasible. It is committed to reducing thermal emissions from its direct real estate portfolio to zero. The Patrimonia Foundation communicates its activities, the performance of its assets and the progress made in sustainability in a transparent manner in the regular reports that are available on its website.

27000

Number of active insured persons

as at 01.01.2025

1630

Number of affiliated companies

as at 01.01.2025

3500

Total assets of the Foundation in millions CHF

as at 01.01.2025

105.2%

Coverage ratio

as at 30.09.2024

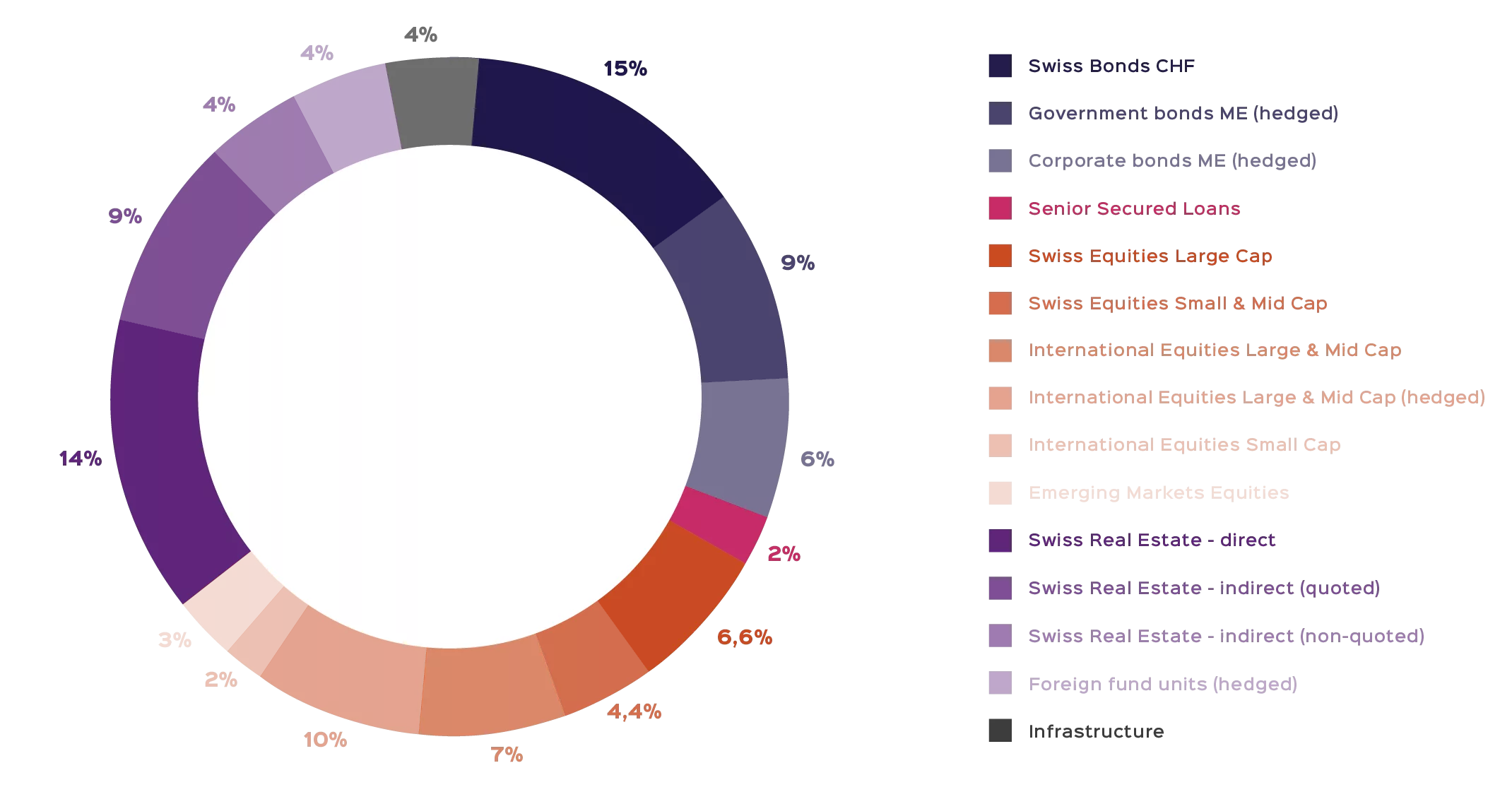

A diversified asset allocation strategy

Patrimonia distributes its assets according to an asset allocation strategy. This diversified allocation, a decision by the Board of Trustees, is reviewed every three to five years. With its long-term approach, it does not make short-term predictions on market performance.

Housing stock

An acquisition and management system based on environmental, social and governance criteria is applied to the housing stock of the Patrimonia Foundation.

36

Real estate in the Canton of Geneva

9

Real estate in the Canton of Neuchâtel

5

Real estate in the Canton of Jura

3

Real estate in the Canton of Fribourg

8

Real estate in the Canton of Vaud

Our management reports

The Patrimonia Foundation makes its various management reports available on a regular basis.

Management reports (annual)

Investment management reports (monthly)

Sustainability reports

Discover our Sustainability Charter

Patrimonia is convinced that its returns, derived from the real economy, can only be generated in the long term by creating sustainable, cost effective, socially equitable and environmentally sustainable wealth.