Patrimonia, a responsible foundation

As a collective pension fund, the Patrimonia Foundation is deeply committed to environmental and social responsibility. Our policy and the measures that we are taking in the field of sustainability can be found on this page.

The environmental responsibility of a pension fund is namely twofold: it must live up to the trust placed in it by its insured persons (fiduciary relationship), and also address the impact of its actions on the world and the investments that it makes to fulfil its role as a pension provider.

Sustainable Development Goals

The Patrimonia Foundation is deeply committed to sustainability. In order to guide its actions in this field, it has adopted the 17 Sustainable Development Goals set by the United Nations.

Patrimonia’s impacts and their management

A distinction must be made between two types of impacts in the case of Patrimonia’s activity: the impacts as an institution that manages a business, employs human resources and enlists providers; the impacts as investors that purchase shares, bonds, real estate and other investment vehicles.

Patrimonia manages its impacts as an institution in accordance with its Governance Policy.

Find out more about Patrimonia’s Governance Policy

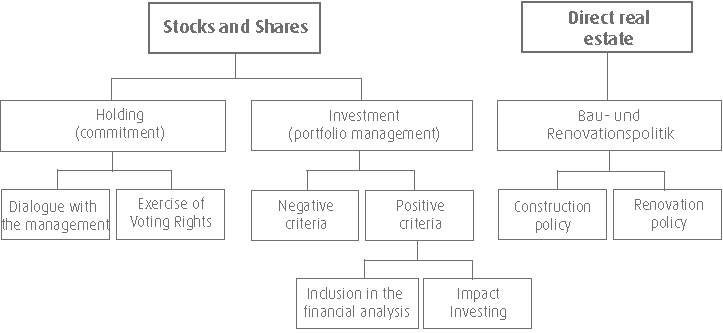

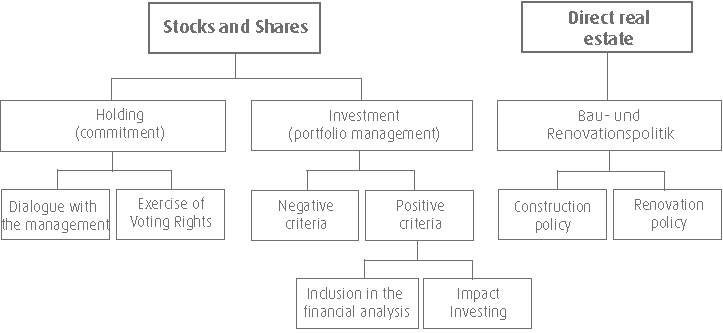

Patrimonia manages its impacts as an investor in accordance with its Sustainable Investment Policy.

Find out more about Patrimonia’s Sustainable Investment Policy

A long-term commitment

Patrimonia is addressing these impacts and their related challenges in accordance with the law (the LOB in particular), in accordance with the codes of conduct to which it has decided to subscribe (ASIP, ASIR, inter-pension, GIP, Ethos), and in accordance with its own institutional values. It is a long-term commitment and Patrimonia has frequently been a forerunner of sustainability.

| 2010 | ISO 9001-2008 Certification – Quality Management System |

| 2011 | Member of the Swiss Pension Fund Association (ASIP) |

| 2011 | Member of Ethos, Swiss Foundation for Sustainable Development |

| 2011 | Membership of Ethos Engagement Pool Switzerland |

| 2012 | Member of the Inter-Pension Association |

| 2014 | ISO 9001-2015 Certification: Quality Management System |

| 2017 | Application of the exclusion list of the Swiss Association for Responsible Investments (ASIR) |

| 2018 | ESG criteria taken into consideration when selecting new managers |

| 2019 | Member of the Group of Pension Funds (GIP) |

| 2019 | First Sustainability Report |

| 2019 | First impact investing in the form of an equity fund |

| 2020 | Membership of Ethos Engagement Pool International |

Sustainable Development Goals

The Patrimonia Foundation is deeply committed to sustainability. In order to guide its actions in this field, it has adopted the 17 Sustainable Development Goals set by the United Nations.

Patrimonia’s impacts and their management

A distinction must be made between two types of impacts in the case of Patrimonia’s activity: the impacts as an institution that manages a business, employs human resources and enlists providers; the impacts as investors that purchase shares, bonds, real estate and other investment vehicles.

Patrimonia manages its impacts as an institution in accordance with its Governance Policy.

Find out more about Patrimonia’s Governance Policy

Patrimonia manages its impacts as an investor in accordance with its Sustainable Investment Policy.

Find out more about Patrimonia’s Sustainable Investment Policy

A long-term commitment

Patrimonia is addressing these impacts and their related challenges in accordance with the law (the LOB in particular), in accordance with the codes of conduct to which it has decided to subscribe (ASIP, ASIR, inter-pension, GIP, Ethos), and in accordance with its own institutional values. It is a long-term commitment and Patrimonia has frequently been a forerunner of sustainability.

| 2010 | ISO 9001-2008 Certification – Quality Management System |

| 2011 | Member of the Swiss Pension Fund Association (ASIP) |

| 2011 | Member of Ethos, Swiss Foundation for Sustainable Development |

| 2011 | Membership of Ethos Engagement Pool Switzerland |

| 2012 | Member of the Inter-Pension Association |

| 2014 | ISO 9001-2015 Certification: Quality Management System |

| 2017 | Application of the exclusion list of the Swiss Association for Responsible Investments (ASIR) |

| 2018 | ESG criteria taken into consideration when selecting new managers |

| 2019 | Member of the Group of Pension Funds (GIP) |

| 2019 | First Sustainability Report |

| 2019 | First impact investing in the form of an equity fund |

| 2020 | Membership of Ethos Engagement Pool International |

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]